The 2026 Xpatulator Cost of Living Indexes places Monaco, Hong Kong, Singapore, and Switzerland among the most expensive locations in the world for internationally mobile professionals. Using New York City as a benchmark at 100, Monaco records an index of 140.3, reflecting extremely high accommodation costs, premium-priced services, and limited housing availability. The principality’s appeal as a tax haven and financial centre drives sustained demand for luxury apartments, which, combined with constrained land supply, underpins the world’s highest expatriate living costs.

Hong Kong follows with an index of 122.4, maintaining its position as Asia’s costliest destination. The territory’s high rents, combined with strong demand for international schooling and imported goods, remain key factors. Although the Hong Kong dollar is pegged to the United States dollar, inflation in housing and utilities has kept living costs elevated. Despite a modest economic slowdown, expatriates continue to face limited space and competition for quality accommodation.

Singapore, at 117.7, remains a global business hub with a robust economy and high consumer confidence. The Singapore dollar strengthened against the United States dollar during 2025, amplifying the local currency cost for expatriates paid in dollars. Strong infrastructure, political stability, and a premium property market contribute to high living costs, particularly in rental housing and international education.

Switzerland, at 106.1, continues to rank among the world’s most expensive destinations. A strong Swiss franc, supported by the country’s reputation for stability and low inflation, has kept prices high in dollar terms. High wages and strong purchasing power among residents further elevate the cost of local goods and services, from healthcare to transport.

Among developed economies, Norway (99.7) and Denmark (96.4) maintain their high-cost status due to high wages, strong currencies, and heavy taxation. These Scandinavian economies provide excellent public services but remain expensive for expatriates, particularly in food, leisure, and accommodation.

2026 Africa Cost of Living

Xpatulator’s 2026 Africa city rankings highlight a recurring expatriate pattern: living costs can sit uncomfortably high even where local incomes are low. The main driver is not day to day local consumption, but the “international professional” basket that concentrates spending into a narrow set of scarce, higher specification goods and services: secure housing, reliable power, private healthcare, international schooling, imported food, and private transport.

Monrovia in Liberia tops this list at 94.9. Costs typically rise for expatriates because supply is thin in secure housing, generator backed utilities are common, and imported groceries and household items dominate weekly spending. Similar dynamics push Libreville in Gabon to 88.4, where a small formal rental market and import dependence can keep prices elevated for the neighbourhoods and standards most expatriates seek. Political transition can also change cost structures through shifting demand, project pipelines, and perceived risk, even when day to day life remains functional.

Abidjan in Cote d’Ivoire at 84.7 and Accra in Ghana at 81.5 reflect larger, more diversified economies, yet expatriate budgets still concentrate into limited housing stock and imported consumption. Inflation and currency trends matter here. Ghana’s inflation has fallen sharply through 2025, easing pressure on some local prices, even as foreign exchange demand can still influence imported items and school fees priced in foreign currency.

2026 America Cost of Living

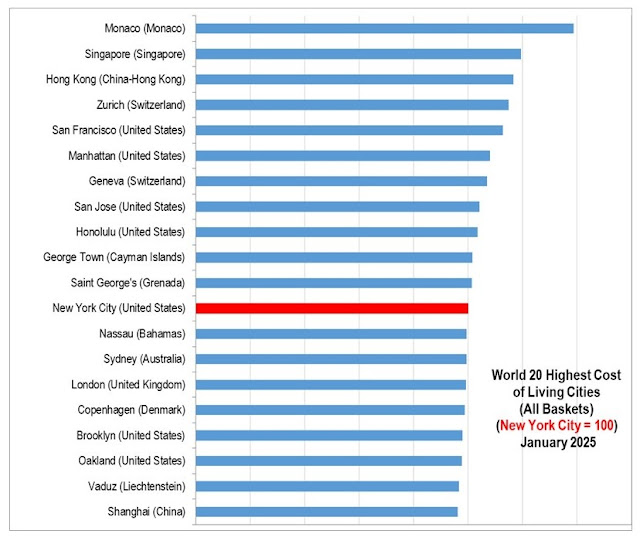

Xpatulator’s 2026 Americas city rankings underline a familiar expatriate reality. Costs rise fastest where housing is constrained, where services are labour intensive, and where imported goods, insurance, and utilities carry structural premiums. New York City is set to 100 as the benchmark, yet Manhattan sits materially higher at 115.6, reflecting the borough’s persistent rent pressure and the premium attached to proximity, space, and amenity. Independent market reporting continues to show elevated Manhattan rents and limited affordability for many households, which feeds directly into expatriate baskets that overweight housing.

The Bay Area follows close behind. San Jose at 114.1 and San Francisco at 112.8 combine high wages in technology and professional services with long running supply constraints in housing. Recent data continues to show high asking rents in both markets, while recent reporting points to renewed strength in top end San Francisco neighbourhoods linked to wealth effects and technology demand, even as affordability remains a constraint for typical earners. These dynamics help explain why even modest changes in rent, insurance, and commuting costs can alter salary purchasing power quickly.

Boston at 99.9 and Greater Washington at 89.9 sit lower than New York City in this set, yet still reflect expensive housing and professional services. Seattle at 98.4 shows a similar pattern, with housing costs and private services driving the expatriate budget more than groceries. Los Angeles at 95.4, San Diego at 92.6, Oakland at 91.4, and Brooklyn at 91.6 illustrate how the wider cost base of large coastal metros can remain high even when particular sub markets cool. Honolulu at 98.6 adds a geographic dimension, where shipping, limited land, and energy costs influence everyday pricing.

2026 Asia Pacific Cost of Living

Xpatulator’s 2026 Asia Pacific city rankings show how expatriate living costs cluster around a few recurring pressures. Housing constraints dominate the top end in global finance and technology hubs. Import dependence raises day to day costs on remote islands. Currency moves against the United States dollar change the relative price of the same basket from one year to the next, even when local prices are steady. Inflation then decides whether those costs settle or compound. Xpatulator’s 2026 international inflation page, reflects a global picture in which disinflation has progressed but has not been uniform across countries or spending categories.

Hong Kong at 122.4 sits at the top of this list because accommodation remains expensive for the locations and unit sizes typically used by international professionals. The Hong Kong Monetary Authority’s linked exchange rate system holds the Hong Kong dollar within a tight band against the United States dollar, so currency has been a smaller driver than rent and services. Recent official data put consumer price inflation at around 1.2 percent year on year in late 2025, which helps explain why the index remains high largely through housing rather than broad based price acceleration.

Singapore at 117.7 combines strong demand for centrally located housing with high prices for private transport, education, and labour intensive services. Inflation has eased compared with earlier peaks, with Ministry of Trade and Industry reporting and Monetary Authority of Singapore commentary showing consumer price inflation around the low single digits in late 2025. Car ownership remains a meaningful cost line item for some assignees, and early 2026 reporting shows the certificate of entitlement premium still sitting at high levels despite periodic tender to tender moves.

Sydney at 100.7 sits just above the New York City benchmark at 100, largely because housing is tight and expensive by global standards. Australia’s inflation has cooled, with the Australian Bureau of Statistics reporting year ended consumer price inflation of 3.4 percent in November 2025, yet housing and related costs remain key contributors. Reuters polling and reporting point to ongoing upward pressure on Australian home prices through 2026, and Australia’s low rental vacancy rates reinforce the practical reality faced by relocators seeking family sized rentals.

2026 Europe Cost of Living

Xpatulator’s 2026 European city rankings show that the region’s highest living costs cluster in places where housing is scarce, services are expensive, and currencies are strong in United States dollar terms. Monaco leads the list at 140.3, reflecting severe constraints on residential supply and persistently high demand from internationally mobile households. Rents and property linked costs tend to dominate the expatriate basket, with private services and premium retail pricing following close behind.

Switzerland occupies the next tier, with Zurich at 117.3 and Geneva at 109.2. High wages, high service standards, and a strong Swiss franc keep local prices elevated for international professionals. Recent Swiss real estate commentary continues to point to upward pressure in rents, reinforcing housing as the primary driver for relocators. Currency has also mattered. United States Federal Reserve and Swiss National Bank series show that the Swiss franc has remained firm versus the United States dollar over the past year, which lifts dollar converted costs even if local inflation is subdued.

Oslo at 103.3 and Copenhagen at 101.6 illustrate how wealthy Nordic capitals sustain high costs through wages and the price of labour intensive services. Housing can still be tight, but expatriates often feel the cost most in dining, childcare, personal services, and transport. These cities also sit in policy environments that deliver high quality public provision, while leaving privately purchased consumption relatively expensive.

London at 101.3 sits just above the New York City benchmark of 100, reflecting expensive housing and paid services, moderated by the breadth of supply and the ability to trade location for space. Guildford at 84.6 and Edinburgh at 83.5 show how costs can remain high in desirable United Kingdom markets outside the capital, particularly once housing, commuting, and childcare are priced in. Exchange rates affect how those costs look to expatriates paid in foreign currency. Sterling has traded around the mid one point three range against the United States dollar in mid January 2026, which influences purchasing power for assignees paid in dollars.

2026 Middle East Cost of Living

Xpatulator’s 2026 cost of living index for Middle East cities benchmarks spending patterns typical of international professionals and managers, with New York City set to 100 for reference. Within this regional list, Jerusalem ranks highest at 98.4, placing it close to New York City in relative terms, while most Gulf cities cluster in the mid to high seventies. Lower scores for several capitals in the Levant and further east do not necessarily indicate an easy assignment, because security, housing quality, and import dependence can still push an expatriate household’s actual outgoings above what local price levels suggest.

Jerusalem’s position tends to reflect tight housing supply, high demand for centrally located neighbourhoods, and a cost structure influenced by imported consumer goods and higher service wages. The economic backdrop also matters. Israel has faced elevated defence spending pressures linked to the Gaza conflict and a fragile ceasefire environment, which can feed through into insurance, security, logistics, and public finance choices over time. Currency movements can amplify these effects for expatriates paid in United States dollars. The Bank of Israel has recently reported a stronger shekel versus the United States dollar, which mechanically raises United States dollar priced living costs when local expenses are paid in shekels.

Abu Dhabi and Dubai sit just below eighty, with pricing shaped by a concentrated premium housing market, schooling choices that often default to fee paying international curricula, and a service economy priced for globally mobile demand. In these markets, the headline cost can hinge on rent cycles, school admissions timing, and whether an employer covers transport and healthcare. Their currency peg to the United States dollar tends to reduce year on year currency noise in United States dollar comparisons, so ranking changes are more likely to reflect local inflation and housing dynamics than exchange rate swings.

Kuwait City, Doha, Manama, Riyadh, and Muscat share several structural cost drivers: a high reliance on imports for many food categories and consumer goods, a relatively small pool of premium expatriate suitable housing, and pricing for discretionary items that can be shaped by regulation and taxation. Exchange rate policy matters here too. Qatar’s peg to the United States dollar and Bahrain’s peg at 0.376 dinars to the United States dollar typically stabilise the currency effect in United States dollar comparisons, while Kuwait’s basket based regime can allow more movement against the United States dollar than its neighbours. Saudi Arabia’s currency peg similarly dampens exchange rate driven shifts, meaning the more material variables for expatriates are usually rents, transport, schooling, and food prices.

Expatriates are urged to evaluate cost-of-living differences carefully when negotiating international assignments, using tools such as Xpatulator’s Salary Purchasing Power Parity Calculator to maintain living standards.